In our Forex.com Broker Review, we will look at their Customer support, Charting tools, Spreads, and Trading fees. You will find out if they are a good fit for you based on our findings. We will also discuss the importance of using a demo account and the security of your funds. Here are some tips to help you make an informed decision on whether or not Forex.com is a good choice for you!

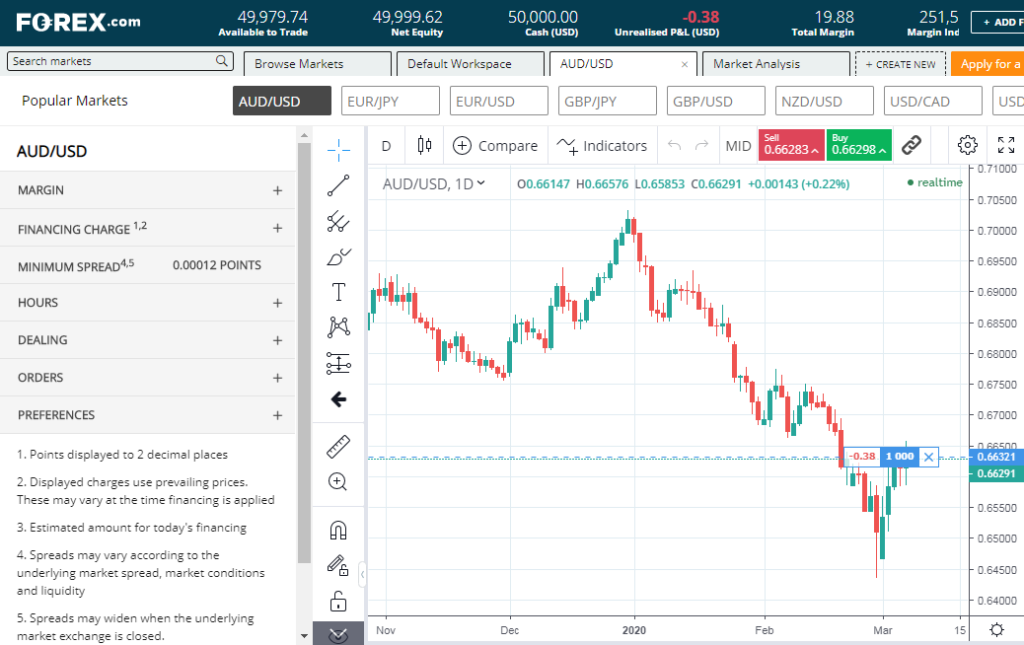

Charting tools

A Forex.com broker’s charting tools are user-friendly and provide the ability to quickly analyze currency pair movements. Price changes are often random events and traders need to manage their risk and assess probability. A chart is a visual representation of price changes over time. The price is plotted from left to right on the x-axis and the most recent price is plotted on the right. Charts can be customized to include different time frames, indicators, and other features to meet a trader’s trading needs.

Technical analysis relies on charts to predict currency pair exchange rate movements. The majority of charting software includes a number of technical indicators for technical analysis and provide graphical representations. Some ig vs oanda trading programs include candlestick charts and point-and-figure charts. These tools can help a trader decide when to enter and exit a trade. Many traders use these tools to help them make trading decisions based on the market.

Customer support

A large number of retail investors have found XTB’s customer support to be excellent. Not only is the support team available by phone Monday through Friday, but they are also accessible via live chat on weekends. Plus500, on the other hand, offers live chat 24 hours a day. Customer support is one of the most important aspects of Forex trading in the United States, where financial regulations are more stringent. However, many retail investors are still skeptical of the quality of customer service offered by https://usforexbrokers.com/reviews/forex-com/.

Spreads

If you’re new to the world of Forex trading, you may be wondering how spreads work. Basically, spread is the difference between the buying and selling price of a currency pair. It’s the easiest way for a broker to make money. If you buy EUR/USD, for example, for 1.1500, your broker will offer it to you for 1.1501 when you sell it. As you can see, there are many different kinds of spreads. You can compare spreads from one broker to another to determine which is right for you.

Spreads in forex are based on the last large number of the price quote. The last large number is one pips. A good way to practice without risking any money is to open a demo or virtual account. Once you are familiar with the system, you can go ahead and start trading with a live account. This type of trading will include exclusive features such as chart forums and live market data. If you are new to the currency market, spreads can be a major factor.

Trading fees

Trading fees vary depending on the currency pair and the size of the trade. Some brokers charge a one-cent commission per dollar traded or $10 for a $10,000,000 trade. Others have sliding scales so that you will pay more if you make larger trades. Other fees may be hidden in their terms and conditions, such as monthly or quarterly minimums, inactivity charges, margin costs, and phone calls. These hidden costs can add up quickly and leave you with a large bill in the mail.

Indirect trading costs are not charged per trade, but can add up over time. These costs include account inactivity fees and withdrawal charges. Although most brokers waive these fees, some also impose third-party fees. While most brokers advertise their commissions in USD, it’s important to note that you’ll have to convert the amount to your own currency before making a deposit. Fusion Markets charges 33 percent less than its competitors, making it a good choice for Australian traders.